It’s a relief that we are finally seeing signs of economic recovery on both sides of the Atlantic but the challenge now is whether companies that responded quickly and cut back in the hard times can respond equally quickly to meet the demands of a growing economy.

When the recession hit in 2007/2008 many companies responded by making rapid reductions in costs: freezing pay increases, reducing working hours and curtailing expenditure on new facilities or product ranges. Those companies that acted quickly 5 or 6 years ago are coming out of the recession with plenty of cash reserves according to the Center on Budget and Policy Priorities. However returning to growth is a critical time for many businesses; as the economy begins to pick up and the orders grow they may not have the capacity to meet the demand or quickly be able to increase that capacity. This will result in missed opportunities and the loss of market share to the more flexible and agile companies that can meet the demand. The smart companies will address this potential problem by investing in additional capacity and products, but to invest for growth after a long recession requires confidence in the market and also in the ability to deliver.

Post-Recession Risks in Managing Growth

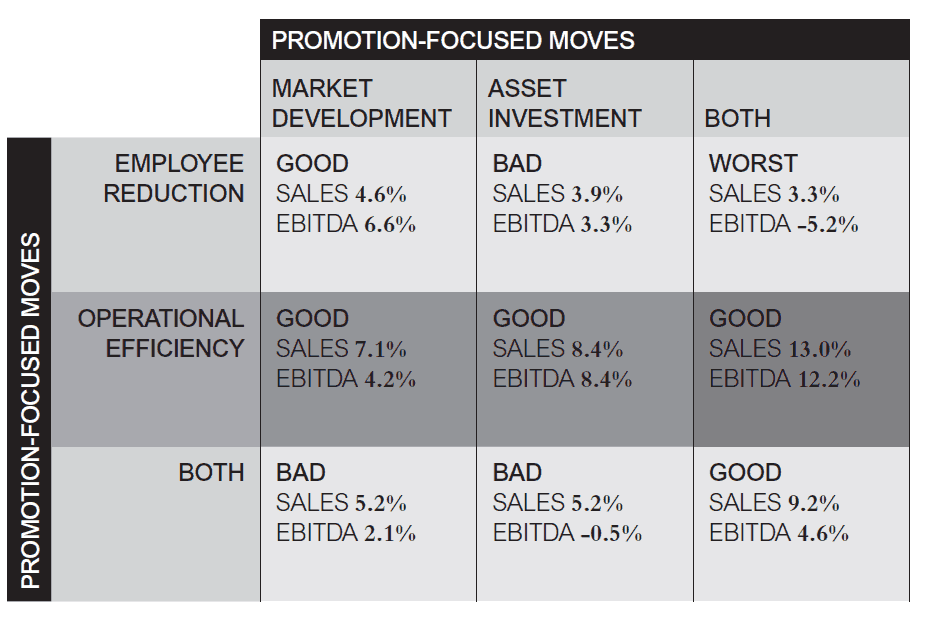

In many ways managing growth is even more challenging than managing cutbacks. No one enjoys making employees redundant, closing offices or withdrawing from markets, but at least the impact of such measures is easy to understand and leads to a rapid payback. On the other hand there is a much higher risk associated with growth and investment and it is this risk that deters many companies from making the decision to invest for the future. A study of 4,700 public companies in Roaring out of Recession by Ranjay Gulati, Nitin Nohria, and Franz Wohlgezogen concluded that “CEOs must be disciplined about cutting costs but also spot investment opportunities that offer reliable returns in a reasonable payback period. If they get the mix right then it helps them tackle short term problems and create a successful medium term strategy.” This study revealed that those companies that did the best in a post-recession environment were those that managed to strike the balance between improving operational efficiency and developing new markets and products.

An Example from Ship Building in the 1950’s

An example of this lack of investment in a post-recession era is the UK ship building industry during the post war boom. Following the Second World War much of the shipping production facilities outside the UK had been destroyed and the UK ship building industry enjoyed a short term boom. However the industry failed to invest in new equipment and working practices, many of which had their roots in the 1930’s. By the 1950’s new shipyards had been re-built around the world using much more modern equipment and working practices. As a result of this lack of investment the UK industry could not compete and today ship building in the UK is a fraction of the size it once was.

There is a similar danger for any company coming out of a recession, the potential risks mean that companies avoid investing in improving processes and productivity, instead they sit tight and enjoy the short term profits and deliver the short term returns demanded by shareholders. The lessons from the past demonstrate that those organisations which make wise investments during a post-recession recovery are those which develop a better long-term future.

The Opportunity to Invest and Grow in a Post-Recession World

Project management provides the perfect framework to manage growth carefully in an organisation. It provides a rigorous process to manage change, ensuring that investments deliver real benefits and the plans for each project are based on a good understanding of the associated risks. This is especially true when organisations are trying to deliver increasingly complex projects with extremely limited resources. For example, Parallel has clients in the fast moving consumer goods industry and previously these organisations had enough spare capacity to manage projects in an inefficient way, but today they must be more focused on the projects they sponsor. Making sure that every new product delivers value to the business and is delivered to market in a cost effective and efficient way. The organisation no longer has the capacity to cope with failing projects so is much more dependent on thorough project management procedures.

How Can Good Project Management Help Post-Recession Investments

Project management provides a framework and governance structure to make sure that investments deliver the expected benefits. A good project management approach answers the following questions.

- Have appropriate responsibilities for the sponsorship, governance and control of the project been defined and established?

- How does this project fit with our corporate strategy?

- Are the benefits, costs and risks sufficiently well understood to be worth the investment?

- Have we got the resources in place to deliver this and the other projects in our portfolio?

- Are the plans for the delivery of this project robust and well developed?

- Have the appropriate stakeholders been consulted to ensure the project delivers the requirements?

- Have the appropriate controls been established so that senior managers have a clear picture of project status?

Given the opportunities for growth presented by the post-recession era project management is now more important than ever.